Page 45 - Book-keeping for Secondary Schools Student’s Book Form One

P. 45

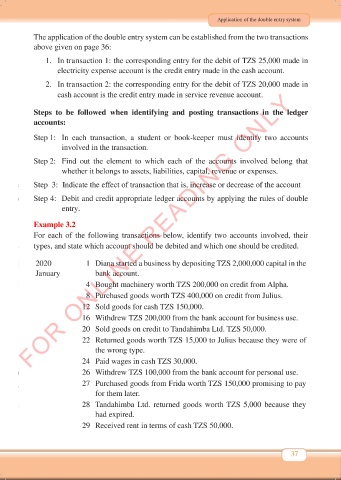

Application of the double entry system

The application of the double entry system can be established from the two transactions

above given on page 36:

1. In transaction 1: the corresponding entry for the debit of TZS 25,000 made in

electricity expense account is the credit entry made in the cash account.

2. In transaction 2: the corresponding entry for the debit of TZS 20,000 made in

FOR ONLINE READING ONLY

cash account is the credit entry made in service revenue account.

Steps to be followed when identifying and posting transactions in the ledger

accounts:

Step 1: In each transaction, a student or book-keeper must identify two accounts

involved in the transaction.

Step 2: Find out the element to which each of the accounts involved belong that

whether it belongs to assets, liabilities, capital, revenue or expenses.

Step 3: Indicate the effect of transaction that is, increase or decrease of the account

Step 4: Debit and credit appropriate ledger accounts by applying the rules of double

entry.

Example 3.2

For each of the following transactions below, identify two accounts involved, their

types, and state which account should be debited and which one should be credited.

2020 1 Diana started a business by depositing TZS 2,000,000 capital in the

January bank account.

4 Bought machinery worth TZS 200,000 on credit from Alpha.

8 Purchased goods worth TZS 400,000 on credit from Julius.

12 Sold goods for cash TZS 150,000.

16 Withdrew TZS 200,000 from the bank account for business use.

20 Sold goods on credit to Tandahimba Ltd. TZS 50,000.

22 Returned goods worth TZS 15,000 to Julius because they were of

the wrong type.

24 Paid wages in cash TZS 30,000.

26 Withdrew TZS 100,000 from the bank account for personal use.

27 Purchased goods from Frida worth TZS 150,000 promising to pay

for them later.

28 Tandahimba Ltd. returned goods worth TZS 5,000 because they

had expired.

29 Received rent in terms of cash TZS 50,000.

37

Book Keeping Form 1 New 2024 FINAL.indd 37 18/10/2024 10:14