Page 268 - Accountancy_F5

P. 268

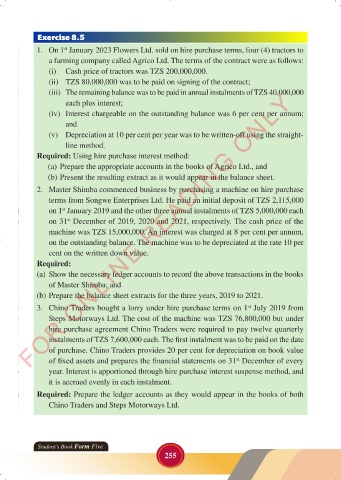

Exercise 8.5

1. On 1 January 2023 Flowers Ltd. sold on hire purchase terms, four (4) tractors to

st

a farming company called Agrico Ltd. The terms of the contract were as follows:

(i) Cash price of tractors was TZS 200,000,000.

(ii) TZS 80,000,000 was to be paid on signing of the contract;

FOR ONLINE READING ONLY

(iii) The remaining balance was to be paid in annual instalments of TZS 40,000,000

each plus interest;

(iv) Interest chargeable on the outstanding balance was 6 per cent per annum;

LANGUAGE EDITING

and

(v) Depreciation at 10 per cent per year was to be written-off using the straight-

LANGUAGE EDITING

line method.

Required: Using hire purchase interest method:

(a) Prepare the appropriate accounts in the books of Agrico Ltd., and

(b) Present the resulting extract as it would appear in the balance sheet.

2. Master Shimba commenced business by purchasing a machine on hire purchase

terms from Songwe Enterprises Ltd. He paid an initial deposit of TZS 2,115,000

on 1 January 2019 and the other three annual instalments of TZS 5,000,000 each

st

on 31 December of 2019, 2020 and 2021, respectively. The cash price of the

st

machine was TZS 15,000,000. An interest was charged at 8 per cent per annum,

on the outstanding balance. The machine was to be depreciated at the rate 10 per

cent on the written down value.

Required:

(a) Show the necessary ledger accounts to record the above transactions in the books

of Master Shimba; and

(b) Prepare the balance sheet extracts for the three years, 2019 to 2021.

3. Chino Traders bought a lorry under hire purchase terms on 1 July 2019 from

st

Steps Motorways Ltd. The cost of the machine was TZS 76,800,000 but under

hire purchase agreement Chino Traders were required to pay twelve quarterly

instalments of TZS 7,600,000 each. The first instalment was to be paid on the date

of purchase. Chino Traders provides 20 per cent for depreciation on book value

of fixed assets and prepares the financial statements on 31 December of every

st

year. Interest is apportioned through hire purchase interest suspense method, and

it is accrued evenly in each instalment.

Required: Prepare the ledger accounts as they would appear in the books of both

Chino Traders and Steps Motorways Ltd.

Student’s Book Form Five

255

23/06/2024 17:36

ACCOUNTANCY_DUMMY_23 JUNE.indd 255

ACCOUNTANCY_DUMMY_23 JUNE.indd 255 23/06/2024 17:36